How the Inflation Reduction Act is Changing the Way Nonprofits go Solar

Note: This article has been updated to reflect our evolving understanding of this legislation

By Rachel Gentile

The Inflation Reduction Act (IRA) is the single largest climate investment that the US government has ever made. Signed into law in August 2022, the legislation includes $369 billion in funding for climate solutions and environmental justice initiatives, with the ultimate goal of reducing carbon emissions by 40% by 2030. A portion of this funding is going to support improved solar incentives that are dramatically changing the way nonprofit organizations can pursue solar.

Why is this important?

After Congress failed to pass the Build Back Better Act at the end of 2021, a sense of uneasiness spread throughout the solar industry (and throughout the environmental movement). In order for the US to meet our climate goals set by President Biden, we are going to need sweeping clean energy legislation and the failure of Build Back Better felt like a crushing blow to many who were eagerly awaiting these policy updates. When the Inflation Reduction Act passed with long-term tax benefits for solar installations and significant boosts for projects serving environmental justice communities, there was plenty to celebrate.

Below, we will break down how some of these new policies are helping make solar more accessible for churches, community centers, affordable housing providers, and other nonprofit organizations serving their communities.

What is in the IRA?

Federal Investment Tax Credit Increase

The most straightforward provision in the IRA is a substantial increase in the federal Investment Tax Credit (ITC). When a homeowner or business invests in solar, they can claim the ITC on their taxes and receive a direct tax credit. Under the previous legislation, the ITC was valued at 26% of the total cost of the installed solar project and was set to step down to 22% at the end of 2022 (and 10% thereafter). The IRA is improving the tax credit dramatically by bumping the ITC up to 30% for the next 10 years. This increase is also retroactive for the 2022 year - any project that was built in 2022 and is now eligible for a 30% tax credit.

A higher ITC not only benefits nonprofits that own their solar array but also those choosing to install third-party-owned systems. Power Purchase Agreements (PPAs) are a great option for organizations that have capital constraints because they require no upfront cost, and the nonprofit organization is not responsible for any maintenance. With the additional revenue from a higher tax credit, Resonant is working with financers to offer more favorable PPA rates to both new and existing clients.

The ITC covers the entire upfront cost of your system, including all equipment and installation costs, meaning it effectively reduces the price of your project by 30%. Installing solar can sometimes require upgrades to utility infrastructure such as a new transformer. Previously, the cost of infrastructure upgrades could not be covered by the ITC, but now these upgrades can be included in the total project cost.

Direct Pay for Nonprofits and Other Tax-Exempt Entities

The most groundbreaking policy change for nonprofits is the addition of a Direct Pay provision. Previously, nonprofits and other tax-exempt entities could not take advantage of the tax credit, making owning your own solar array significantly less economical for nonprofits than for tax-eligible entities. These organizations could work with third-party financers to set up a PPA or a hybrid ownership option but both of these solutions saw lower lifetime savings than an ownership option.

Under the new Direct Pay provision, solar customers will be able to receive a cash reimbursement for the full value of the investment tax credit. The Treasury has not released an application or process for Direct Pay, but nonprofits that work with Resonant will have step-by-step assistance as we navigate this process together.

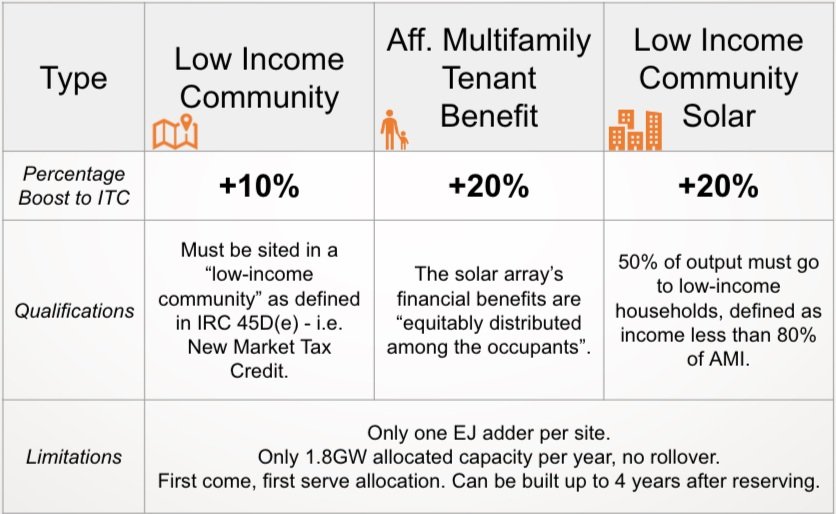

Environmental Justice Adders

In addition to increasing the base value of the ITC, the IRA has also implemented 3 environmental justice-focused incentive adders that can make a project eligible for up to a 50% tax credit. These benefits are designed to help address some of the barriers to equitable access for low-income residents and limited-resource communities. The details have yet to be finalized by the Treasury but we know that the total capacity for these benefits will be limited to 1.8 GW each year. We encourage organizations to contact us at your earliest convenience to see which incentives you qualify for.

Environmental Justice Location Adder (10%)

A project becomes eligible for an additional 10% tax credit if the project itself is located in a low-income census tract.

Affordable Multifamily Tenant Benefit Adder (20%)

A project that is located on a low-income residential building that is evenly distributing the electricity savings among tenants becomes eligible for an additional 20% tax credit. We are still waiting for more information on how this one will look and what the requirements will be

Low-Income Community Solar (20%)

Any project that is sending at least 50% of the output from its system to low-income households becomes eligible for an additional 20% tax credit. This is a great option for organizations with large roofs or parking lots but relatively low energy usage such as houses of worship.

The Treasury has until February 12, 2023, to finalize the guidelines and application process for these environmental justice adders. We expect that the application will require a signed contract and interconnection agreement with the utility company.

What’s Next?

The IRA is a complex piece of legislation with significant implications for solar across market segments. If you’re interested in a deeper dive into the details of this legislation, you can check out this recording from our webinar Solar for Nonprofits: New Policies, Big Benefits.

Organizations that are interested in taking advantage of these additional benefits but haven’t begun the pre-development process should reach out to info@resonant.energy with a copy of their electric bill. This will allow Resonant to get started with initial designs and contracting so that your project can be ready to apply for these exciting new benefits when the portal opens in 2023. We expect these programs will fill up fast so we want our clients to be the first in line.

For the first time, nonprofit organizations are fully empowered to take control of their own clean energy future. Though there is still some uncertainty about how all of these policies will be implemented, our team is feeling energized by the forward momentum in the clean energy industry. We are excited to continue working with nonprofits to find the ideal solar solution that best fits your financial needs while supporting your organization’s mission.