2025 Tax Bill Implications for Solar Energy

8/15/25 - This blogpost has been updated to reflect the new Safe Harbor rules posted by the Treasury

By Rachel Gentile

On July 4, 2025, President Trump signed the tax reconciliation bill H.R.1., commonly referred to as the Big Beautiful Bill, into law. There are many aspects of this legislation that pose a significant threat to Americans across the country, including cuts to Medicaid and expansions of immigration enforcement. We recognize that many of our nonprofit partners and clients are deeply impacted by these policy changes and ongoing federal funding cuts. Most significantly for our work, H.R.1. significantly accelerates the phase out of the 48(e) investment tax credit (ITC) for commercial solar energy, which has played a major role in making solar affordable for the nonprofits and multifamily housing organizations we serve. The 48(e) tax credit will be eliminated for projects that have not substantially begun before July 4, 2026, or are not placed in service before December 31, 2027. The 25(d) residential solar tax credit will end even sooner at the end of 2025.

While the final version of the law was not as bad as it could have been based on some of the drafted language in previous iterations, this legislation is still a significant blow to the work that we do. Industry experts predict that the bill’s cuts to solar and wind will push rising electricity prices even higher, likely leading to a market slowdown and job losses throughout the industry — especially in the single-family solar sector, which employs the majority of all solar professionals. We are very confident that Resonant Energy and the work that we do to advance equitable commercial solar deployment will continue in a post-tax credit world; in the meantime, this policy has established a series of hard deadlines for commercial solar customers to get their projects started in order to preserve their ITC value (ranging from 30-70%, depending on the project specifications).

Below, we’ve broken down all of the key deadlines and implications for solar projects under this new tax law:

Safe Harbor

Deadline: July 4, 2026

Safe Harbor is a tax provision that allows a solar project that has already undergone significant development to lock in its tax credit under the current tax law, protecting the project from economic challenges that could result from a change in tax code. Our team has helped clients safe harbor tax credits in past years when the investment tax credit was scheduled to step down; this process has happened before and has plenty of policy precedent.

The recent tax bill points to an existing IRS statute that says projects must “begin construction.” The simplest way to comply with this requirement is to sign a contract and complete a down payment equal to at least 5% of the total project cost – our team is recommending 10% as a buffer so that if the project has any cost increases, the Client is not at risk of losing the tax credit. Under the new tax law, projects will have until July 4, 2026, to safe harbor the tax credit.

Projects that are unable to safe harbor have one more opportunity to receive the tax credit – projects that receive Permission to Operate by December 31, 2027, will also be eligible for the tax credit. The Investment Tax Credit for battery storage was not cut by the tax bill, so projects that include 3-phase battery storage can still receive a 30% tax credit on the storage portion of the project.

Executive Order Changing Safe Harbor Requirements

While the concept of Safe Harbor is not unprecedented, President Trump has maintained his administration’s precedent for issuing executive orders of questionable legal integrity. On July 7, the White House issued an executive order titled “Ending Market Distorting Subsidies for Unreliable, Foreign Controlled Energy Sources” which delegates the Treasury to tighten the regulations related to Safe Harbor, specifically what qualifies as “beginning of construction.” The Executive Order gives the Treasury 45 days (or a deadline of August 18, 2025) to create these new guidelines.

Updated August 15, 2025:

The Treasury has issued Notice 2025-42 addressing the changes put forth in the executive order. While the Safe Harbor requirements will be tightened for large projects, projects under 1.5 MW-AC will still be able to use the 5% Safe Harbor test.

Foreign Entity of Concern

Deadline: December 31, 2025

The new tax law restricts solar projects from accessing the investment tax credit if the solar project has significant involvement from what Congress has deemed a “Foreign Entity of Concern” or FEOC. Solar projects cannot be owned or receive “material assistance” from an organization that is deemed a foreign entity of concern, primarily China, North Korea, and Iran. Operationally, this means that projects will need to limit the amount of equipment sourced from these countries to qualify for the tax credit. In 2026, projects cannot have more than 60% of the total equipment cost coming from FEOCs and this maximum threshold will decrease by 5% annually. Projects that safe harbor before December 31, 2025, will not be subject to these FEOC requirements, but after that date, all new projects will need to comply to access the tax credit.

Our team is currently researching the best and most cost-effective pathways to obtain FEOC-compliant equipment, but we are fairly certain that compliance will be feasible for most projects. Likely, the simplest way to ensure compliance will be to use domestically manufactured equipment, which can also make projects eligible for the additional 10% Domestic Content ITC Adder.

Compliance with these FEOC requirements will likely require additional paperwork and may lead to longer lead times on equipment, which is important to keep in mind for clients anticipating a 2026 contract signing. Projects with a battery storage component should prioritize safe harboring before the December 31, 2025, deadline because it will be very hard to source non-FEOC batteries.

Tax Credit Adders

One positive aspect of the final version of the tax bill is that it did not eliminate any of the existing Low-Income and Environmental Justice Bonus Tax Credit adders. While these adders will cease to exist when the tax credit is eliminated after 2027, for the time being, we have reason to believe that projects will still be able to receive these bonus tax credits. Below, we have broken down what you need to know about each adder.

Low-Income Bonus Tax Credits

The final deadline for the 2025 Low-Income Bonus Tax Credit application period was August 1, 2025. Through this program, projects can apply for an additional 10-20% tax credit on top of the base 30%. This program is competitive and requires a significant application process.

The Low-Income Bonus Tax Credits were not explicitly mentioned in the recent tax bill, so we have reason to believe that the Department of Energy will open a new application period in 2026 and 2027, as they are mandated to do by the 2023 Inflation Reduction Act. In practice, the Trump administration may attempt to hamstring the program by understaffing the departments that are responsible for reviewing applications. We will be keeping a close eye on the status of this program and will share updates in our newsletter if we learn any more information.

Energy Community

Map Created by Baker Tilly, check your exact address here

This program offers a non-competitive 10% bonus tax credit value to projects that

A) are located near retired fossil fuel generation or extraction locations,

B) are located in census tracts with high rates of historic fossil-fuel related employment and current unemployment

or C) are on land that is designated as a brownfield site for non-petroleum contamination.

The FY25 census data was recently published, and the Cape, as well as a large portion of western and central Massachusetts, now qualify for this adder based on current unemployment rates. Projects located in the affected counties are automatically eligible for an additional 10% tax credit, as long as the project is safe harbored or receives permission to operate between June 2025 and May 2026.

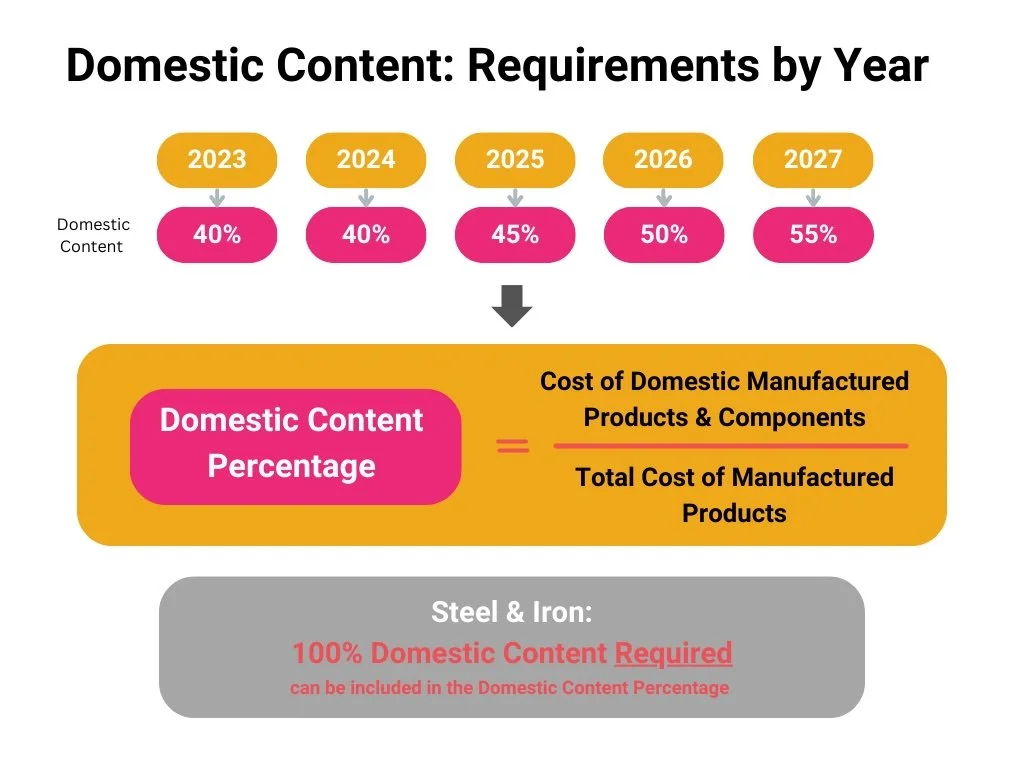

Domestic Content

Projects are eligible for an additional 10% tax credit if the project utilizes a certain percentage of domestically manufactured equipment. There are no changes to this adder under the new tax law. Given the new FEOC requirements in 2026, there will likely be high demand for domestically produced equipment, which may lead to longer lead times.

Conclusion

The Big Beautiful Bill represents a significant blow to both the solar industry as a whole and the nonprofits that Resonant serves. There are still many unanswered questions about how these regulations will be enforced and what the simplest compliance pathways will be, but our team is tracking these changes as they occur. If you have any questions about what these changes mean for your project, please reach out to your business development manager or info@resonant.energy.